Traditional mortgages are fixed-rate mortgages, adjustable-rate mortgages (ARMs), refinance loans, second mortgages, and home equity lines of credit. When looking to buy a home, it is important that you meet with a mortgage broker or bank to determine the best option for your particular needs and desires in a home loan, but here are a few definitions and guidelines to get you started.

Fixed-Rate Mortgages

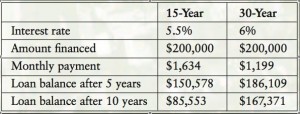

Fixed-rate mortgages are just that, mortgages that have a fixed interest rate for the life of the loan. These types of loans run for 15 years or 30 years, and are probably the most common traditional loan type out there. If you go with a 15-year loan, you’ll pay off the entire loan in 15 years. The same is true for 30-year loans.. you pay it off in 30 years. (Some folks, though, decide to make an extra payment per year, and this cuts down your loan lifetime significantly!) Here is a chart from the National Association of Realtors® that shows the difference in numbers between a 15-year fixed rate mortgage and a 30-year one.

Adjustable-Rate Mortgages (ARMs)

ARMs are traditional loans that do not carry a fixed interest rate. In fact, the initial interest rate for an ARM is typically lower than that of a fixed-rate mortgage, but after a specified amount of time (usually 3 or 5 years), the interest rate may go up or down. This means the amount you pay each month will go up or down as well. ARMs are great for those who are financially secure and can handle the payment changes, and are also a good idea for those who intend to sell their home by the time the initial interest rate is set to change.

There are certain tidbits of information that you should know before agreeing to an ARM, though, so make sure you gather this information from your lender before signing on the dotted line:

- The length of time your initial interest rate will stay fixed.

- How often the interest rate can change during the life of the loan.

- Whether or not there is a maximum and/or minimum interest rate for the loan.

- How the adjusted rate is determined.

- The maximum monthly payment you could be required to pay.

Refinance Loans

With the interest rates this year continuing to stay very low, refinancing has been a hot item (and has kept mortgage brokers busy!). Refinancing means that you pay off your current loan completely and get a new loan at a lower interest rate. Why do this? Because your monthly payments could be lower, and the life of your loan could be shorter. It is important to know what fees will be charged before refinancing, because sometimes fees (even large ones) can run the bill up enough to make the refinance not worth it. Typically, to refinance, you need to have at least 20% equity in your home built up and a good credit score. It also will be more beneficial to you if you plan on owning the house for quite some time in order to make back all the closing costs and fees you paid.

Second Mortgages

Taking out a second mortgage means you are borrowing against your equity, using your house as collateral. The risk is that if you take out a second mortgage and can’t pay it back, you will lose your home. The amount of money you are loaned for a second mortgage is determined by how much you still owe on your first mortgage, and is up to the lender to decide.

Home Equity Lines of Credit (HELOC)

A home equity line of credit is sort of like using a credit card. You borrow a certain amount of money over a certain amount of time. Like a second mortgage, you use your house as collateral, and face the same risk — losing your house if you can’t pay the loan back. Also like a second mortgage, the lender determines how much it will loan you due to the amount of equity you have built up in your home. HELOCs generally have a variable interest rate (so you should ask a lot of the same questions as stated above for ARMs), and if you sell your home, you’ll have to completely pay off your HELOC.

If you would like us to refer you to a mortgage broker, we have a few that we work with and highly recommend! Contact us to find out more.

Pingback: Mortgage Blog

Pingback: What You Need To Know About Traditional Mortgages | Forex Futures Trading

Pingback: » What You Need To Know About Traditional Mortgages » Second Mortgage Calculator

Pingback: What You Need To Know About Traditional Mortgages | Low Loan Refinancing